INTRODUCTION

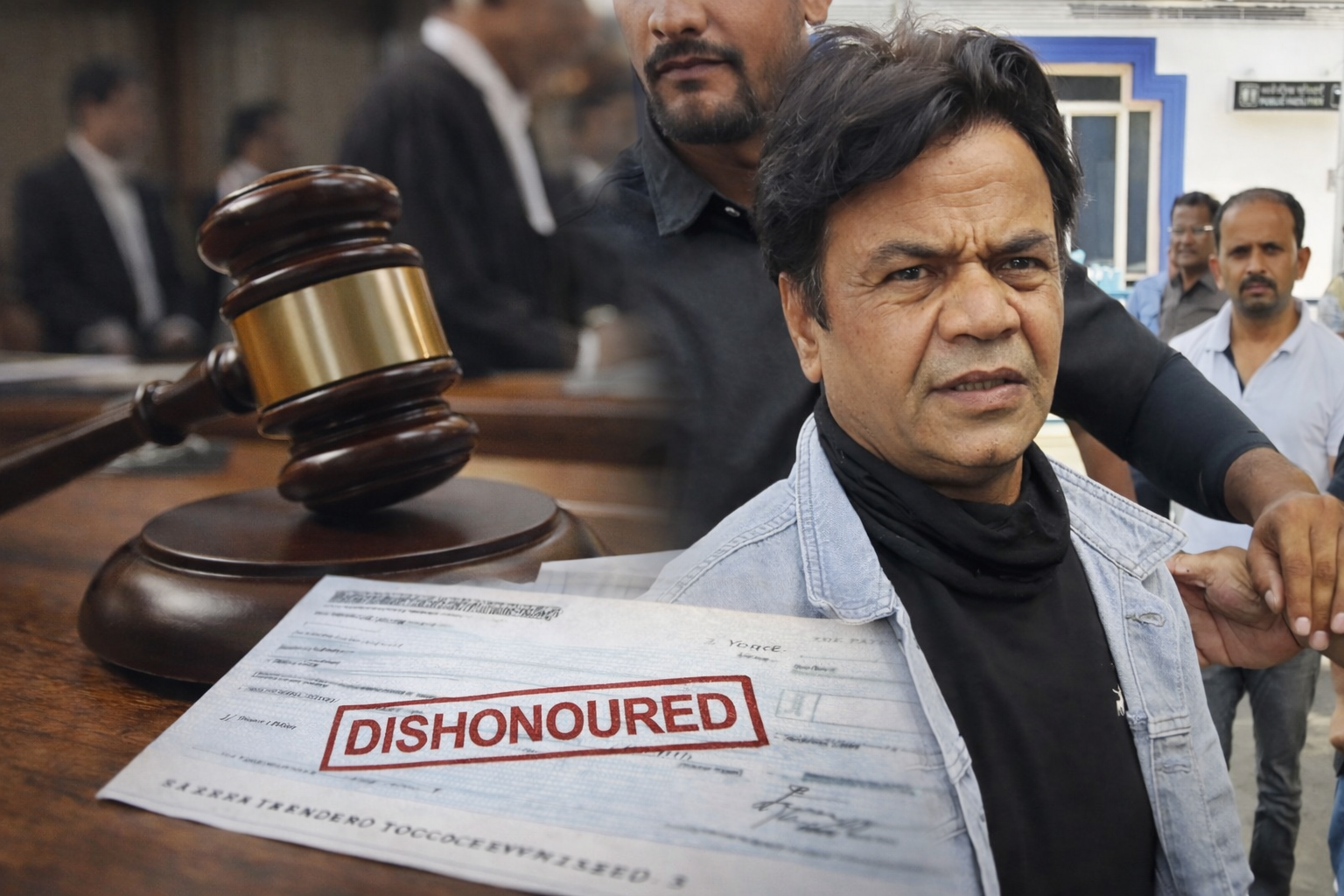

Cheque Bounce Cases are once again at the centre of national legal and financial discussions as courts across India grapple with mounting pendency and stricter enforcement under the Negotiable Instruments Act. What was once considered a routine commercial dispute has now become a major litigation category, affecting businesses, individuals, and even high-profile personalities

In recent months, several high-visibility cases involving entrepreneurs, corporate executives and public figures have brought renewed attention to the issue. At the same time data from judicial dashboards and banking reports show that cheque dishonour disputes remain among the largest contributors to criminal case backlogs in metropolitan magistrate courts

The renewed spotlight on Cheque Bounce Cases comes at a time when India’s digital payments ecosystem is expanding rapidly, raising questions about why cheque-related disputes continue to persist

What Is Happening

Cheque Bounce Cases arise under Section 138 of the Negotiable Instruments Act, 1881, when a cheque issued towards repayment of a legally enforceable debt is dishonoured due to insufficient funds or other technical reasons. If payment is not made within the prescribed statutory notice period, criminal proceedings can be initiated

According to data from the National Judicial Data Grid, cheque dishonour cases account for a significant share of pending criminal matters in subordinate courts across several states. Metropolitan cities like Delhi, Mumbai, Bengaluru and Chennai continue to report high volumes of such filings

The Supreme Court of India has in the past few years taken note of the enormous pendency of Cheque Bounce Cases and issued directions to streamline procedures These include encouraging mediation allowing summary trials and promoting digital service of summons

Meanwhile, Reserve Bank of India guidelines have also emphasised improved banking compliance and real-time transaction alerts to reduce dishonour incidents However despite technological improvements, the number of disputes remains substantial

Legal experts note that economic stress in certain sectors delayed payments to MSMEs, and informal lending practices often lead to cheque defaults

Key Data and Statistics

Official judicial data highlights the scale of the issue

| Year | Estimated Pending Cheque Bounce Cases | Share in Criminal Case Backlog |

|---|---|---|

| 2021 | 35 lakh+ | Around 15% |

| 2022 | 38 lakh+ | Around 16% |

| 2023 | 40 lakh+ | Around 17% |

| 2024 | 42 lakh+(estimated) | Nearly 18% |

Source: National Judicial Data Grid public court data reports

These numbers indicate a steady rise over the past few years. In simple terms, nearly one in every six to seven criminal cases pending in lower courts relates to cheque dishonour matters

Metropolitan regions account for a disproportionately high share due to greater commercial activity. However, semi-urban districts are also witnessing growing filings, particularly linked to small business transactions

The data also suggests that disposal rates, though improving, are still struggling to keep pace with fresh filings

Why This Matters for India

The implications of rising Cheque Bounce Cases go far beyond courtroom statistics

First, the burden on the judiciary affects overall justice delivery. When magistrate courts are clogged with financial disputes, other criminal matters face delays

Second, for businesses—especially MSMEs—cheque dishonour directly impacts cash flow. Many small enterprises rely on post-dated cheques as security for goods or services. When these bounce, working capital cycles get disrupted

Third, criminalisation of cheque dishonour has sparked policy debates. Industry bodies have, in the past, suggested decriminalising minor economic offences to ease pressure on courts and promote ease of doing business

However, lenders argue that strict enforcement acts as a deterrent against wilful default

From an economic perspective, rising Cheque Bounce Cases can signal liquidity stress within certain sectors. Analysts often treat such trends as indirect indicators of financial health at the grassroots level

Industry and Expert Perspective

Legal practitioners point out that Section 138 proceedings are unique because they combine criminal procedure with essentially civil financial disputes

Bar associations across major cities have reported that a significant portion of daily court listings consists of cheque dishonour complaints

Policy discussions at the Union government level have examined whether certain categories of economic offences should be decriminalised to improve business climate. In earlier consultations, the Ministry of Finance had sought stakeholder feedback on reducing criminal liability for minor procedural violations However cheque dishonour under the NI Act remains criminally prosecutable

Financial analysts believe digital payment growth through UPI and electronic transfers could gradually reduce reliance on cheques. According to RBI data, digital transactions have increased exponentially in the past five years, while cheque usage in volume terms has declined relative to electronic modes

Yet cheques continue to be widely used in real estate transactions, rental agreements, supplier contracts and informal lending arrangements

Experts also highlight that many Cheque Bounce Cases are eventually settled through compromise, often after lengthy litigation

Challenges and Risks

There are multiple structural challenges linked to Cheque Bounce Cases

One major concern is misuse. Legal observers have occasionally flagged instances where security cheques are presented despite underlying contractual disputes, leading to criminal complaints

Another issue is delay in service of summons and repeated adjournments Even with Supreme Court guidelines promoting summary trials, procedural bottlenecks remain

For accused individuals, the reputational and financial risks are significant Criminal proceedings can affect creditworthiness and business credibility

On the other hand, genuine creditors often face long wait periods before recovery Even after conviction, actual recovery of money may involve additional civil execution steps

There is also a policy tension between protecting creditors’ rights and avoiding over-criminalisation of commercial disputes

What Happens Next

In the short term, courts are expected to continue pushing for faster disposal of Cheque Bounce Cases through mediation and digital hearings

Several High Courts have already issued practice directions to streamline case management. E-courts infrastructure expansion may further assist in reducing pendency

In the longer term, the future of cheque transactions itself is under scrutiny. As India’s financial ecosystem shifts toward real-time digital payments cheque-based disputes may gradually decline. However, complete elimination appears unlikely in the near future

Policy reforms if any would likely focus on balancing deterrence with business-friendly compliance frameworks

For businesses and individuals, the message is clear financial discipline and documentation are more critical than ever

FAQs

What are Cheque Bounce Cases under Indian law

Cheque Bounce Cases arise when a cheque issued for repayment of debt is dishonoured and the drawer fails to pay within the statutory notice period under Section 138 of the NI Act

Is cheque bounce a criminal offence in India

Yes. Under current law cheque dishonour for insufficient funds can attract criminal prosecution, including fines and imprisonment

How long does a cheque bounce case take

Timelines vary widely. While summary trials are intended to be faster, many cases take several months to years due to court backlog

Can cheque bounce cases be settled

Yes. Many Cheque Bounce Cases are resolved through out-of-court settlement or court-mediated compromise

Are digital payments reducing cheque disputes

Digital payments are growing rapidly, but cheques remain common in certain sectors, so disputes continue

CONCLUSION

Cheque Bounce Cases continue to represent a significant intersection between India’s financial system and criminal justice framework. While digital transformation is reshaping transactions, cheque dishonour disputes remain deeply embedded in commercial practice

With millions of cases pending and policy debates ongoing, the issue is not merely legal—it is economic and structural. Whether through judicial reforms, technological shifts or legislative changes the handling of Cheque Bounce Cases will remain a key indicator of India’s evolving business environment